The edge computing landscape in the semiconductor industry in Europe

Generative AI is often described as a once-in-a-generation technological shift comparable to the advent of cloud computing. Across Europe, companies are experimenting, piloting and cautiously investing.

During the webinar “The edge computing landscape in the semiconductor industry in Europe” Luis Fernandes (Senior Research Manager, EMEA Digital Infrastructure Strategies) and Alexandra Rotaru (Data and Analytics Manager, IDC Edge Computing Spending Guide) explored the intersection of Generative AI (GenAI) and edge computing, and the question of whether Europe is prepared to move from AI consumer to AI creator.

GenAI potential vs reality

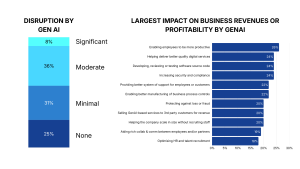

For most European enterprises, GenAI has not yet been a disruptive shockwave, instead, it feels more like a steady ripple.

How disruptive is GenAI today?

- Around 25% of companies report no disruption at all

- More than 65% see only minimal to moderate impact

- Just 8% experience significant disruption to their business model or competitive position

Despite this, the link between GenAI and performance is already visible. Companies seeing revenue growth tend to be the same ones increasing IT and GenAI investment, largely driven by higher employee productivity and improved digital services. Just over half of EU companies now recognise GenAI as strategically important, signalling a slow but meaningful shift from experimentation toward intent.

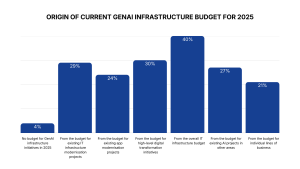

Funding GenAI: pitfalls and best practices

Almost every European company is funding GenAI in some form, but how they fund it matters. Many projects are financed by reallocating funds from other infrastructure initiatives. This “appropriation” approach may accelerate pilots, but it comes at a cost, this practice is warned against, as it can lead to technical debt, project delays, and serious questions around IT resilience and security.

A more sustainable approach, adopted by less than half of companies, is to secure GenAI funding from dedicated AI project budgets or directly from the lines of business that will benefit from the outcomes.

GenAI adoption is expanding but still has a long road ahead to be in extensive use in a substantial way. Although 3 out of every 4 companies are in some way at least experimenting with GenAI in their IT infrastructure, only 16% of respondents have made an extensive use of it. There is still a portion of the market that is still highly resistant to using GenAI in their IT infrastructure.

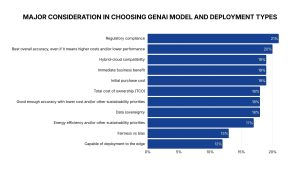

When choosing GenAI platforms and models, European priorities reflect the region’s regulatory and operational realities. Top decision drivers include regulatory compliance, accuracy and reliability, hybrid-cloud compatibility (enabling pilots in public cloud and production in private environments). Costs and total cost of ownership are not yet dominant concerns, but they are rising.

While GenAI attracts attention, edge computing remains a low priority:

- Edge is overshadowed by security, compliance, and AI infrastructure.

- Less than one-sixth of infrastructure budgets in the EU go to edge.

- Budget growth lags behind the broader EMEA region.

Edge workloads are one of the few areas where EU companies express greater concern than their EMEA peers.

The European Edge Computing market

The European edge computing market is expected to reach $62 billion by 2026, with Edge AI accounting for nearly 20%. Edge computing is seen as a path to reducing or controlling costs, but while EU companies wish to reduce and optimise their costs, there is a reasonable concern around security and digital sovereignty.

Interesting to note is also the rise of two benefits that have been seen as extremely relevant in surveys on GenAI: increased employee performance, productivity and efficiency and agility/flexibility for new digital services.

Challenges and opportunities

Edge computing is steadily gaining importance worldwide as a core component of digital infrastructure, complementing the cloud, with global spending expected to reach around $100 billion by 2029, driven largely by service providers and the growing need for real-time analytics, automation, flexibility, improved customer experience, and cost reduction.

While the Americas dominate edge investment thanks to large-scale workloads and a more favourable regulatory environment, and Asia-Pacific follows with strong government-backed AI initiatives, Europe accounts for 20% of global spending and shows healthy but fragmented growth.

The EU’s reliance on external suppliers, shortages in talent and skills, and lack of scale slow innovation and deployment, even as sectors like travel, telecommunications, and healthcare begin to invest more heavily. Despite lagging behind the US, Europe benefits from strong policies, high AI readiness, and the potential to build edge infrastructure and AI factories.

To remain competitive, the EU must accelerate investment in edge computing, strengthen semiconductor autonomy, harmonise standards, foster cross-border partnerships, and invest in talent, recognising that GenAI will increasingly drive edge adoption and that success will depend on not just chips, but also skills, power, cooling, and collaboration across the ecosystem.

Key takeaways

The future of Edge computing is not just about technology, it’s about ecosystem, strategy, and foresight. GenAI will push computation closer to where data is created, Europe must act decisively to secure its place, and the semiconductor industry will play a critical enabling role.

Success will depend on coordinated investment, infrastructure, and skills because building Edge requires to have basic foundations in place to support the investment. The time to lay those foundations is now, or Europe risks falling behind in a landscape that is moving faster than ever.

Invest in your company’s future by partnering with us to implement strategic initiatives that drive results.